Swedish Startup "Clones"

Exporting ideas from the US to the Nordics

In the 1990’s, three brothers made a name for themselves by building an eBay “clone” called Alando. Within 100 days of launch, ebBay acquired Alando for tens of millions of dollars. This was the start of what later became Rocket Internet, a firm that went on to build numerous clone companies, i.e. companies that were inspired by existing companies in different geographies.

Sweden has produced numerous highly innovative and original startups over the years. But, lots of “clone” startups have also been born in Sweden. That is, startups that - whether intentionally or not - are incredibly similar to existing US-based startups in terms of business model, brand, and messaging.

There’s a clear pattern: US startup launches and usually raises at least a Series A. Then, appx 2-3 yrs after launch, a Swedish lookalike emerges (note: in some cases, the US startups themselves have taken ideas from abroad, often from Asia).

My point with this isn’t to show that opportunities can be found in studying emerging startups in the US and launching similar companies in the Nordics. That’s widely understood at this point. In fact, in many instances, it doesn’t work out in the long run. Rather, it’s simply to highlight a few examples of US companies and their Nordic “clones”.

This trend is prevalent across industries/verticals/business models, including consumer tech, marketplaces (B2B/B2C/P2P), payments, SaaS, CPG, etc.

And just to be clear, I'm not saying there's anything wrong with seeking inspiration in different markets. Rather, in the cases where this works, I think it's a brilliant strategy.

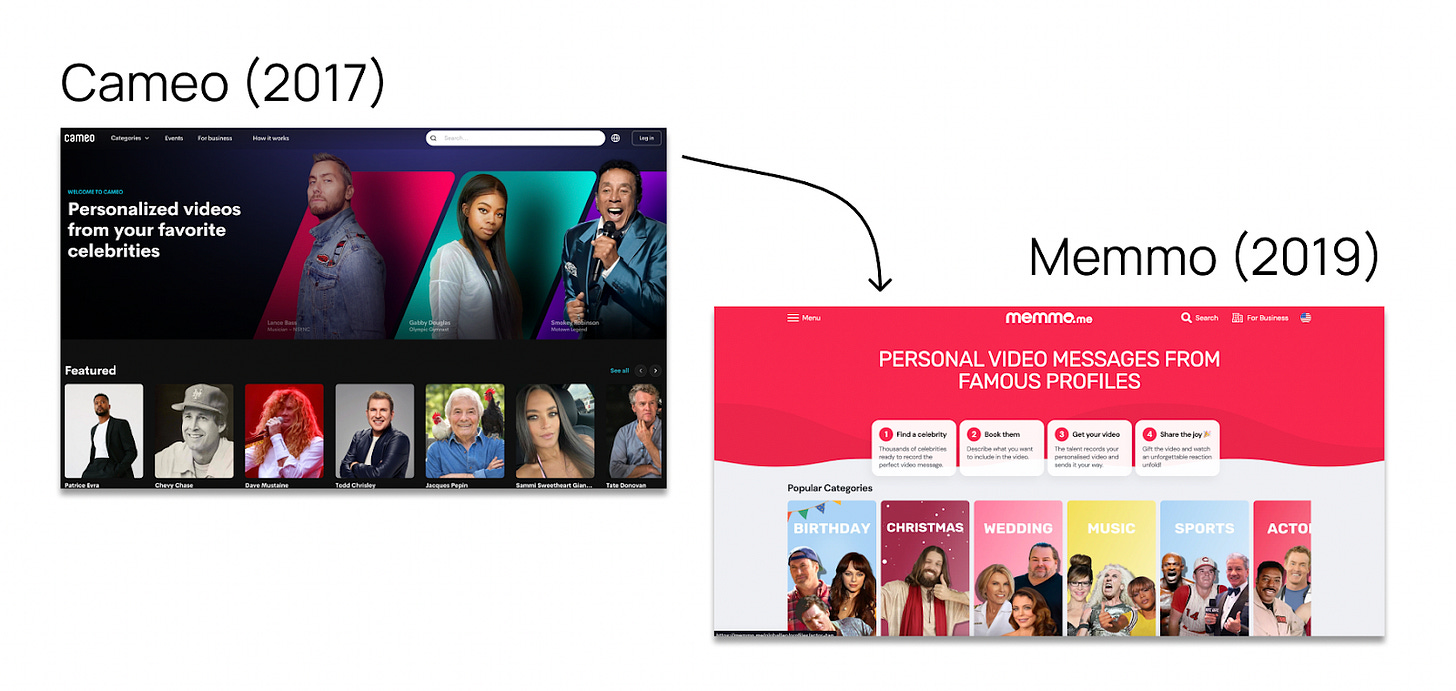

Cameo (USA) is a consumer-tech marketplace on which consumers can buy interactions (video greetings) from celebrities such as famous actors/actresses, athletes, etc. Cameo has raised over $160M from Valor Equity Partners, TCG, etc. Founded in 2017.

Memmo (Sweden), founded in 2019 (+2 yrs), is incredibly similar. They’ve raised $24M from LeftLane Capital, J12, and FJ Labs.

Opendoor (USA) launched in 2014 on a mission to disrupt the home-selling experience by extending offers to homeowners looking to sell their home in as little as 24 hours, without even seeing the home. Opendoor raised $1.9B prior to its SPAC merger in late 2020.

Movesta (Sweden), was founded in 2020 (+6 yrs) with a very similar value-proposition. The company has raised at least $4M.

HipCamp (USA) launched in 2013 and has raised $98M from firms such as Benchmark Capital and Index Ventures. It’s a marketplace to discover and book unique camping spots. Think of it as AirBNB for camping.

Acamp (Sweden) was founded in 2020 (+7 yrs) with a similar value proposition. They’ve raised over $4M.

Clutter (USA) was founded in 2014 with a vision to modernize self-storage with an improved customer experience (incl. on-demand storage, pick-up/delivery, etc.). They’ve since raised $296M.

Vinden (Sweden), founded in 2017 (+3 yrs), is bringing a similar service to market in Sweden.

One of the more obvious categories is the micro-mobility space. In 2017, both Bird and Lime launched in the US, pioneering the category. Before going public in 2021, Bird raised ~$780M, however, the company is now trading at a $70M market cap in the public markets. Lime has raised over $1.5B (mix of debt and equity).

In 2018 (+1 yr), Voi launched in Sweden, and has since raised over $500M.

Kitchen United (USA) is one of several companies in the US operating virtual food-courts. This is different from simply a ghost kitchen, where, in many cases, just one restaurant brand/menu is being prepared per kitchen. With a virtual food-court, multiple brands/menus are prepared under the same roof and operations and are available through just one order. This allows groups, for example a family, to place a single take-out/delivery order consisting of sushi, pizza, and burgers. KitchenMix United launched in 2017 and has raised $150M.

Curb, a Stockholm based startup founded in 2020 (+3 yrs), has raised over $25M to build something similar, i.e. a portfolio of brands/menus available through a single delivery order.

Continuing on the restaurant-tech theme, Virtual Dining Concepts (VDC) launched in the US in 2018. The company helps existing restaurants increase their revenue by utilizing excess capacity in their kitchens to prepare delivery-only food for virtual restaurant brands. For example, if a restaurants is already serving hamburgers, then VDC could approach them and have them prepare hamburgers on behalf of one of VDC’s delivery-only brands. The restaurant gets an additional revenue stream and VDC is able to grow their portfolio of virtual brands across the country. VDC also operates several celebrity/influencer food brands. The company has raised $20M and is one of several US companies in this space, along with Forward.

Eatable (Sweden), is a Stockholm based startup bringing a similar approach to the market. Eatable develops their own dining concepts/brands and enables restaurants to cook and fulfill delivery-orders generated by these virtual brands. Eatable launched in 2020 (+2 yrs).

Billie and Flamingo launched in the US in 2017 and 2018. They were both initially focused on offering razor subscriptions for women. They’ve since expanded their product offerings, but have not strayed far from their original brand identities and ethos. Billie raised $35M before being acquired for $310M and Flamingo was launched by the men’s shaving brand, Harry’s, which has raised a total of $790M.

Estrid (Sweden) launched in 2019 (+2 & +3 yrs) with a very similar brand identity, ethos, and product offering as Flamingo and Billie. The company has raised ~$25M.

Italic (USA) launched in 2018. The online brand/retailer is bringing the Costco model to modern retail. Initially, members had to pay an annual subscription fee of $60 (at one point the annual fee was $120) and get access to Italic’s product assortment. By working directly with manufacturers overseas Italic is able to source products from the same factories that produce clothing and other products for well-known brands, but Italic sells these products to consumers more or less at-cost. With this model, they make the majority of their profit on their membership subscriptions, similarly to Costco. Since launch, Italic has iterated on their model and pricing several times, and is now open to non-members as well. Italic has raised over $15M.

Singular Society (Sweden), a Stockholm based brand, launched in 2020 (+2 yrs). They too have implemented a similar membership model in which members pay a monthly fee of 95 SEK (or 950 SEK per year) in order to buy their products close to at-cost. Their product assortment and brand is very similar to that of Italic. Singular Society appears to be an incubation within H&M.

Warby Parker (USA) is an eyewear brand that launched in 2010. The company sells reasonably priced prescription eyewear (and even contact lenses now) DTC, both online and through their own brick and mortar stores. They were among the first (if not the first) eyewear brands to offer a “try-at-home” kit which allows customers to get up to five frames sent to them in the mail to help them decide which frames to buy. Warby Parker raised $535M before going public, and now trades at a ~$1.88B market cap, down from a near $7B market cap several months ago.

Nividas (Sweden) offers a similar customer experience and value proposition as Warby Parker, i.e. affordable prescription eyewear, sold (mostly) DTC, and with a focus on the customer experience both online and offline. Their stores look very similar to Warby Parker’s and they too offer the “try at home” kit. Nividas was founded in 2013 (+ 3yrs).

Both companies even have the same promotion on their landing page right now: buy two pairs of glasses, and get a 15% discount.

These are just a handful of examples… there are so many more, especially if you zoom out and look at the entire Nordic region. Many of these examples are in the consumer (tech and/or product) space, but there are just as many across B2B.

Find me on Twitter here of email: erik@interlacevc.com